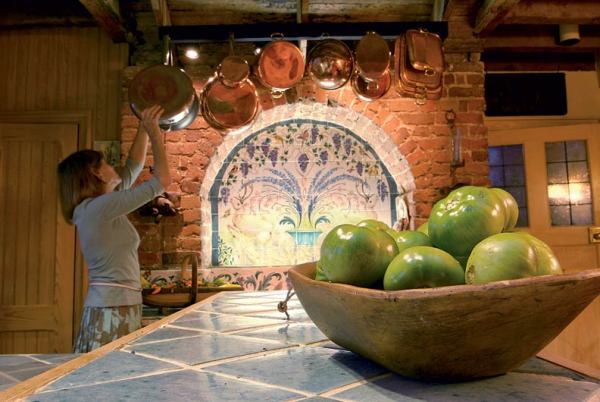

This 1922 kitchen renovation was a project the entire family had to approve. The redesign was mapped out with the help of historic preservationists. (Photo: Abby Greenawalt)

Our 203-year-old house is on the Connecticut historic register…but falling down around us! We desperately want to restore it, but we are facing large expenses. Are there any grants or other money sources to help us?

That is the $64,000 question. Unfortunately, unless you are satisfied with “it depends,” the answer is not simple. While there are sources of financial help for old-house work, they vary widely across the country, and they take some homework to access. Here are some ideas to get you started.

Grants (gifts of money to be used for specific purposes) come from public sources (federal, state, or local governmental entities) or from private sources (sometimes individuals, but more often foundations). Nonetheless, almost all grants are awarded on the condition that there will be a benefit to the general public, and that’s why most restoration grants go to publicly owned buildings or ones that are opened to the public.

Outright grants for the restoration of a historic house that is both privately owned and privately occupied are very rare. Still, you might want to peruse foundation directories at your local library or online. If available at all, locally based foundations are more likely than statewide or national foundations to have restoration grants for homeowners. Some local municipalities may have façade improvement grants that subsidize the costs of improvements to houses in historic districts. These programs, while commendable, are still uncommon, and often provide modest grants to homeowners only in low-income or “distressed” neighborhoods.

Tax incentives and low-interest loans, two other kinds of financial assistance for homeowner restoration projects, are more common. These programs will typically be administered either by a governmental agency or a nonprofit organization.

To be eligible for these programs, usually your house must be officially designated as historic by either a local historic commission or by inclusion on the National Register of Historic Places. The property can be either individually designated or listed as “contributing” to a historic district in which it is located.

In addition, the restoration work you undertake must adhere to certain standards such as the Secretary of the Interior’s Standards for the Treatment of Historic Properties. A governmental agency or local preservation nonprofit organization will usually review and certify the completed work.

Tax incentives may either abate your property taxes, or reduce your federal, state, or local income taxes. When you complete a certified restoration project, an abatement will reduce or freeze your real-estate taxes for a period of time—10 years, for example—after which your taxes will be assessed as usual. Income-tax incentives either reduce the amount of your taxable income (deductions) or directly reduce the amount of tax you owe (credits).

The best-known and most widely used tax incentive is the Rehabilitation Tax Credit (also known as the Investment Tax Credit, or ITC), which can provide a federal income-tax credit in an amount up to 20 percent of the eligible costs of rehabilitating a certified historic structure. But here’s the catch: this program can only be used for income-producing properties. So unless your home is used as a rental property, your restoration project won’t be eligible for these tax credits. If all or some of the historic house is rented out, however, it’s definitely worth learning more about this tax incentive.

Currently 45 states have restoration tax incentives. While some of these programs limit the benefits only to income-producing properties, many others apply to owner-occupied historic houses. The most comprehensive and up-to-date summary of these programs is probably this list compiled by the National Trust for Historic Preservation.

As an example, the state of Georgia provides an eight-year freeze on property taxes if the rehab project increases the market value of the owner-occupied residence by 50 percent or more. This type of abatement is intended to eliminate one disincentive of restoring a historic house: that the restoration improvements would result in burdensome, increased property taxes. In addition, Georgia also offers homeowners a state income-tax credit equal to 10 percent to 15 percent of the costs of eligible restoration projects.

Connecticut offers a 30 percent state income-tax credit for eligible projects on certified historic houses. There are conditions, however, like a minimum project expenditure ($25,000), a maximum tax credit per dwelling ($30,000), and location (the property must be in a distressed area defined by the state). These kinds of conditions are typical of tax-credit programs in other states as well. Many states, through so-called “enabling” legislation, also allow local municipalities—counties, townships, cities—to enact restoration tax incentives.

Revolving loan funds are offered by some statewide or local historic-preservation nonprofit organizations (and some governmental agencies), for which owners of historic homes may be eligible. The idea is this: a pool of money is lent to homeowners—usually with more lenient terms than typical market-rate home-improvement bank loans—for improving their historic homes. As the loans are repaid, the payments “revolve” back into the loan fund so that additional rehabilitation projects can be funded.

The advantages of rehabilitation loan funds administered by historic-preservation organizations are several: The interest rates may be lower than market rates, the qualification criteria may be more lenient, and technical assistance is often provided. In addition, since these loans are often concentrated in “targeted” neighborhoods, they act as catalysts for the revitalization of the entire neighborhood.

As an example, the Cleveland Restoration Society, and its partner banks, offer a Neighborhood Historic Preservation Program that provides below-market 1 to 1/2 percent (APR), 12-year loans to homeowners in that city’s most central urban neighborhoods. Last year, the loan program allowed homeowners to complete 28 projects worth more than $2 million in rehabilitation construction.

The availability of these rehabilitation-loan programs varies greatly across the country. Begin your inquiry at PreservationDirectory.com, or at your local community-development agency or preservation nonprofit organization. So there’s help out there. The assistance may be spotty, modest, or sticky with “red-tape” procedures, but it’s certainly worth checking out before embarking on a restoration project.